Disciplined Growth Investors: Why Patience, Not Speed, Builds Big Returns

Dec 19, 2025

Disciplined growth investors play a longer game than most. They are not hunting quick wins or reacting to daily noise. They focus on businesses with durable advantages, expanding earnings power, and the ability to compound over years, not weeks. Volatility does not scare them because volatility is not risk. Losing discipline is.

These investors accept drawdowns as the cost of admission. They understand that superior growth rarely travels in straight lines and that short-term discomfort is often the price paid for long-term asymmetry.

Discipline and Patience: The Real Growth Engine

Discipline is not stubbornness. It is adherence to a process when emotion argues otherwise. Growth investing without discipline quickly devolves into chasing momentum at the wrong time and abandoning conviction at the worst moment.

Patience is what allows compounding to work uninterrupted. Selling too early because of fear, boredom, or headline pressure is one of the most reliable ways investors sabotage their own returns. Markets reward those who can sit through uncertainty while businesses execute.

The long-term market trend is upward, but only for those who remain invested long enough to experience it. Discipline keeps you in the game. Patience lets the math do the work.

Selling Put Options: A Tactical Tool for Disciplined Growth Investors

One strategy that fits naturally into a disciplined growth framework is selling put options, particularly after sharp market corrections or broad sell-offs. These are periods when fear spikes and option premiums become inflated.

Selling puts is not speculation. It is structured patience.

When markets fall hard, investors rush to buy protection. That demand drives up put premiums. Selling puts during these moments allows disciplined investors to monetise fear while positioning themselves to acquire quality growth stocks at lower prices.

Why Timing Matters

The optimal window for selling puts is not during calm markets. It is after volatility expands and sentiment deteriorates. Elevated premiums reflect emotional urgency, not improved probability for the buyer.

By waiting for these conditions, the investor tilts the odds. They are paid upfront for committing capital only if price falls further. If it does not, they keep the premium. If it does, they acquire shares at a level they already considered attractive.

The Structural Advantage of Selling Puts

Selling a put is effectively a paid limit order.

If the stock remains above the strike price, the option expires worthless, and the premium becomes income. If the stock falls below the strike, shares are assigned at the strike price minus the premium received.

For example, selling a $50 put on a stock trading at $55 for a $3 premium results in an effective purchase price of $47 if assigned. That is superior to placing a simple limit order at $50, which earns nothing while waiting.

This approach aligns perfectly with disciplined growth investing. You are either paid for waiting or paid to own quality at a discount.

Risk Still Exists, Discipline Controls It

Selling puts is not risk-free. If the underlying business deteriorates, the assignment can turn into ownership of a declining asset. This is why discipline matters more than the tactic itself.

Only sell puts on companies you are willing to own for the long term. Size positions conservatively. Avoid leverage. Treat assignment as inventory acquisition, not failure.

Used correctly, put selling is not aggressive. It is controlled exposure with defined intent.

Leveraging Put Premiums for Call Options

Disciplined investors can extend their options strategy by using the premiums received from selling puts to purchase call options on strong stocks. However, it is crucial to focus on Long-Term Equity Anticipation Securities (LEAPS) rather than short-term options.

Why LEAPS?

LEAPS are long-term options contracts that typically expire in one to three years. They offer several advantages:

1. More time for the underlying stock to appreciate

2. Less time decay compared to short-term options

3. Potential for significant leverage if the stock price increases substantially

Investors can get free leveraged exposure to strong stocks by using put premiums to purchase LEAPS call options. This strategy allows them to maintain their core long-term holdings while positioning themselves for potential outsized gains if their selected stocks perform well.

Mass Psychology and Market Dynamics

Understanding Mob psychology is crucial for disciplined growth investors. The principles of mass psychology suggest that astute investors should not short the markets, as it’s akin to gambling. Instead, they wait until the masses buy or experience FOMO (fear of missing out) before taking the opposite position. Conversely, when the masses are panicking and selling, these investors look for opportunities to buy quality companies at a discount.

This approach aligns with contrarian investing, where investors seek to profit from extreme market sentiment. Disciplined investors can make more informed decisions and capitalise on market inefficiencies by recognising when the crowd is overly optimistic or pessimistic.

The Risks of Shorting

While shorting can be profitable in the short term, the profit potential is limited, and the risk is unlimited. This is why disciplined growth investors generally avoid shorting as part of their strategy. Instead, they focus on identifying long-term investment opportunities to provide sustainable growth.

Let’s look at two examples to illustrate this point:

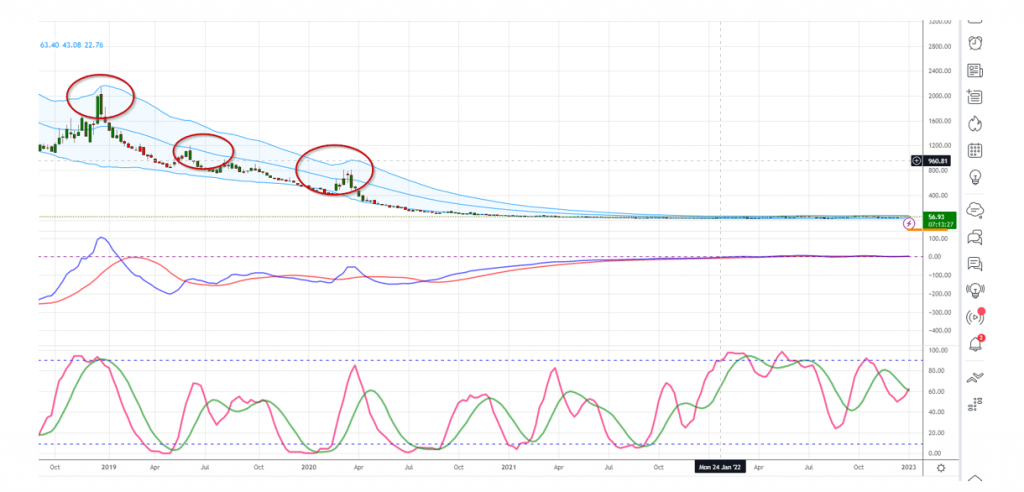

Monthly Chart of SQQQ (bearish fund)

If you held SQQQ through thick and thin, you would have been blown out of the water and probably out of this solar system. Despite all the pullbacks the Market has experienced, ranging from mild to insanely wild, SQQQ has dropped from 2,000 to 55.17. Contrast that with its sister fund, TQQQ.

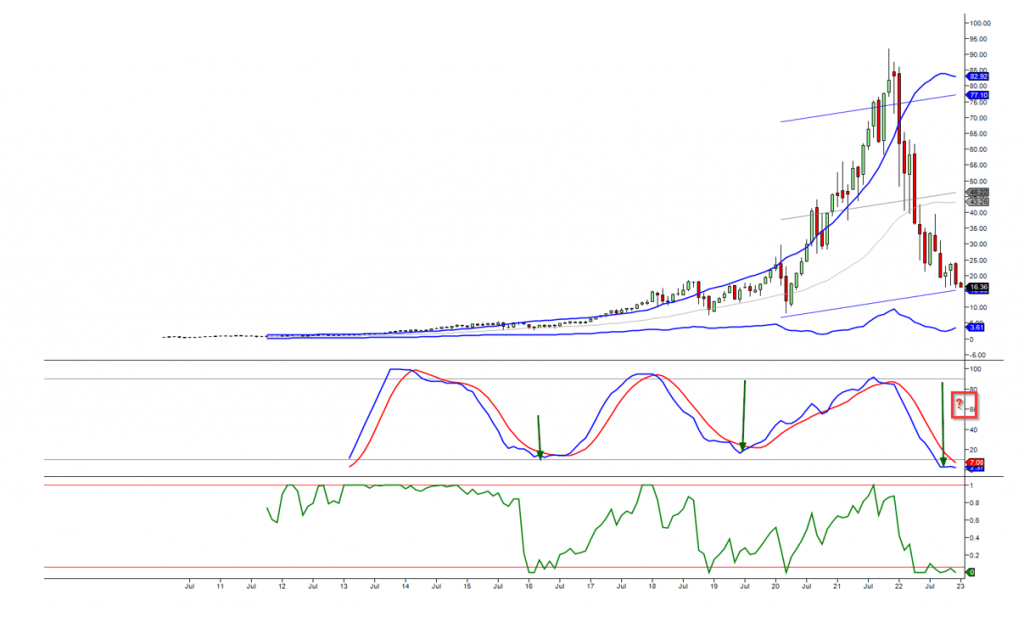

The Monthly Chart of TQQQ: A Nearly Assured Recovery

If you don’t panic, your odds of recovering are close to 90%. Look at the above chart. You can make even more if you open additional positions when the Market trades in the highly oversold zone, as indicated by the green arrows. Bears can make money, but must be fast and agile, or they won’t last. On the other hand, bulls have Time on their side, a luxury no bear will ever have.

If we were doing the reverse, shorting in a bull market, we would be dead in the water as the odds of making a comeback would be extremely slim. TQQQ will recoup its losses and then some, but the same cannot be said of SQQQ, which has lost over 90% since Dec 2018.

Disciplined growth investors understand the value of Time in the Market versus timing the Market. They focus on identifying quality companies with long-term growth potential and avoid short-term trading strategies that carry significant risk. By taking a strategic and disciplined approach to investing, they can achieve sustainable growth over Time and avoid the pitfalls of short-term market fluctuations.

The Value of Time in the Market

Disciplined growth investors understand the value of time in the market versus timing the market. They focus on identifying quality companies with long-term growth potential and avoid short-term trading strategies that carry significant risk. By taking a strategic and disciplined approach to investing, they can achieve sustainable growth over time and avoid the pitfalls of short-term market fluctuations.

As Michael Montaigne’s famous quote suggests, “The greatest thing in the world is to know how to belong to oneself.” This sentiment resonates with disciplined growth investors who understand the importance of staying true to their investment strategies and not being swayed by short-term market noise.

Conclusion

Disciplined growth investors do not play defence by hiding, nor offence by gambling. They commit to long-term ownership of quality businesses and accept volatility as the price of compounding. They avoid shorting, avoid prediction games, and instead structure positions that benefit from time, patience, and mispriced fear.

By combining disciplined stock selection with tactical tools such as selling put options and selectively deploying premiums into long-duration exposure when conditions justify it, they tilt probability in their favour. This is not about cleverness. It is about alignment. Capital is deployed only when price, psychology, and long-term growth intersect.

Understanding mass psychology sharpens this edge. Markets misprice not because investors lack information, but because they lose emotional control. Disciplined growth investors do the opposite. They stay patient when others rush, systematic when others react, and focused when others fragment.

Big returns are not born from bold forecasts. They emerge from steady process, emotional restraint, and respect for compounding. That is how growth becomes durable, repeatable, and earned, not accidental.